A Smart Rabbit Has Three Burrows — A practical, no-nonsense guide for Gen X & Boomers (with charts, tables & a 30-day plan)

You know the proverb: “A smart rabbit has three burrows.”

Nice image, but…. for people hitting mid-career or retirement age, it’s not cute — it’s a survival manual.

This piece goes deep — data + plain-language analysis — and finishes with a short, usable plan you can start in the next 30 days. Charts and tables are up top (scroll) so you can eyeball the numbers and then read the “what to do” parts.

TL;DR — the punchline

- The modern economy is noisy: inflation still above target in places, central banks are moving rates around, and longevity + healthcare costs make retirement longer and more expensive.

- A single income stream or a single nest-egg is fragile. Think three burrows: stability, growth, flexibility. (Charts above show the environment and how most people’s savings stack up.)

- Simple, practical moves (emergency fund, reduce fees, low-friction side income trial, tax-advantaged catch-ups) give the most bang for your buck.

Quick data snapshot (look at the charts)

You’ll see four visuals I generated:

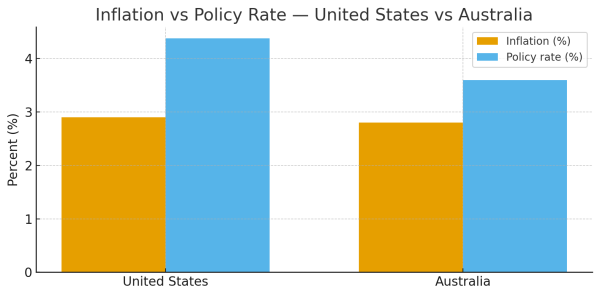

- Inflation vs policy rate — US and Australia (Figure 1). The US CPI is running near ~2.9% (Aug 2025 reporting) while Fed policy has been elevated (midpoint of the target range ~4.25–4.5%). Australia’s CPI is around 2.8% and the RBA cash rate is ~3.6%. These numbers matter because they determine how far your savings have to run to keep purchasing power.

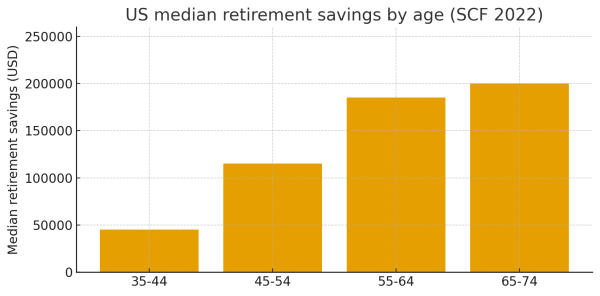

- US median retirement savings by age (SCF 2022) (Figure 2). Median balances are modest for many: e.g. 35–44 ≈ US$45k, 45–54 ≈ US$115k, 55–64 ≈ US$185k, 65–74 ≈ US$200k — remember: median, not mean. Plenty of households have very little.

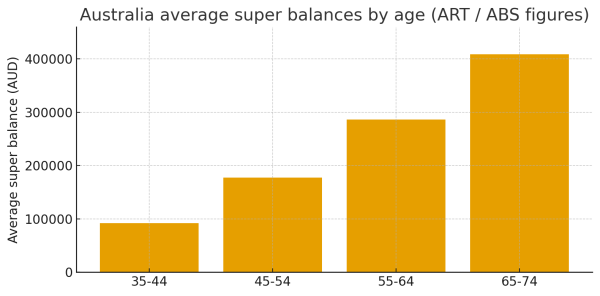

- Australia — average super balances by age (ABS/ART/ASFA figures) (Figure 3). Average balances climb with age but many still fall short of what a “comfortable” retired lifestyle costs in Australia; the averages (combined male+female) for 35–44 / 45–54 / 55–64 / 65–74 are roughly A$92k, A$178k, A$286k, A$409k respectively (source: ABS/ART/ASFA).

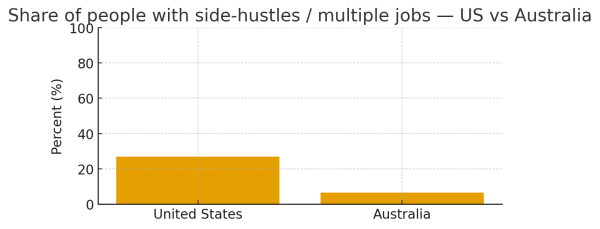

- Side-hustle / multiple-job snapshot (Figure 4). In the US recent surveys show ~27% of adults report side hustles; in Australia about 6.6% are multiple job-holders (ABS) though other measures of gig work vary by definition. Side income is common and useful as a third burrow.

(If you’re viewing on mobile: charts and tables are above — they’re the same figures I’ll reference below.)

What “three burrows” means now — practical translation

Burrow 1 — Stability (the safe base)

Purpose: cover essentials and downside. Examples: pension / super / a conservative income sleeve (bonds, short-term cash, high-quality corporate bonds), home equity that’s not leveraged to the hilt, an emergency fund.

Why: rising health and living costs + market volatility means you want a reliable floor.

Burrow 2 — Growth (inflation-beating, longer-term)

Purpose: let your capital grow enough to keep up with inflation and fund discretionary spending. Examples: diversified equities (low-fee index ETFs), targeted property exposure, dividends, business equity.

Why: many retirees’ median balances are too small; growth is essential to avoid eating principal too fast.

Burrow 3 — Flexibility (optionality)

Purpose: liquidity and choices — a way to patch things fast. Examples: a tested side income (consulting, tutoring, rental), a liquid investment sleeve, or the ability to downsize or geo-arbitrate if needed.

Why: if stocks or property stumble, your side income or quick access cash keeps you afloat without selling when markets are down.

Simple portfolios (illustrative — not personalised advice)

Pick one that matches where you are — these are conceptual splits, not strict rules.

- Late-career / near retiree (60+) — “Keep the roof on”

Stability 60% | Growth 25% | Flexibility 15% - Early Gen X (45–54) — “Grow but have a plan”

Stability 30% | Growth 50% | Flexibility 20% - Already retired (65+) — “Income + safety”

Stability 50% | Growth 25% | Flexibility 25%

Notes: “Stability” can be a combination of pension income, high-quality bonds, and a cash buffer. “Growth” is long-horizon equities and low-fee funds. “Flexibility” is not just money — it’s capacity to work, borrow, or monetise assets.

Real-world moves: what to actually do (clear, simple, high ROI)

The 30-day plan (do these in this order)

- Check the floor — find your pension/super statement and calculate the monthly income it will buy (or expected drawdown). If you’re in Australia check your Age Pension eligibility basics; if US check Social Security projections. (This calibrates Burrow 1.)

- Emergency fund — top up until you have 6 months of essentials (aim for 6–12 months if you’re near retirement and mortgage-heavy). Keep it liquid.

- Fee audit — check fees on your super/pension/managed funds. Shave 0.5–1% in fees and your compounding improves massively over a decade. (Small change, big effect.)

- Catch-ups — if you’re eligible, make catch-up contributions to super/401(k)/IRA (your plan rules apply). You don’t need perfect timing — start now.

- Test a small side gig — pick one thing you can trial for 4 weeks (consulting, tutoring, Airbnb room, online course). Keep costs tiny — it’s proof of concept.

- Debt triage — pay down high-interest debt (credit cards, personal loans) before aggressive investing.

- Estate & health check — review your will, power of attorney, and health cover. Health shocks are a major retirement risk.

Longer (3–12 months) actions

- Consolidate old accounts if it reduces fees.

- Rebalance your growth sleeve to low-fee broad-market ETFs.

- Consider a small allocation to income-producing assets (dividend ETFs, term deposits, short bond ladders) if you need cashflow.

- If property is part of your plan, run conservative stress tests (rental voids, interest rate increases).

A few specific tips for Gen X & Boomers

- Gen X (late-40s to mid-50s): You’ve got time but not endless. Double down on growth while building an obvious liquidity buffer. Use salary sacrifice / pre-tax contributions where it helps.

- Boomers (60+): Protect the floor. Sequence-of-returns risk (big market drop right as you withdraw) is real. Keep enough liquid to cover the next 3–5 years of withdrawals, and use guaranteed streams (pensions, annuities where sensible) if they make sense.

- Do the math with longevity in mind. People are living longer on average — plan for 20–30 years of retirement income for many households. Healthcare and long-term care are budget items, not surprises.

The checklist (quick view)

I’ve shown a concise Three Burrows – quick checklist table above. Quick highlights:

- Burrow 1: Confirm pension/super income & add emergency cash.

- Burrow 2: Reduce fees, favour low-cost diversified funds, don’t chase hot tips.

- Burrow 3: Run a low-cost side gig pilot; keep cash to bridge 3–6 months for opportunities or crises.

Short case study — real, simple

A mate (early 60s) did this:

- Kept his super as the stability (base income),

- Kept a small rental property that covered most of its costs and provided extra income as flexibility,

- Did part-time consulting for clients two days a week as growth + flexibility (small income, kept his skills sharp).

If one source slowed, the others kept him stable without panic selling. That’s the rabbit strategy.

Risks & things to watch (so you can dig a smarter burrow)

- Inflation creep — even “low” inflation chips away at fixed incomes. Make sure some assets aim to outpace inflation.

- Policy & pension changes — governments tinker with retirement rules; don’t rely on promises. Keep flexibility.

- Health spending & longevity — plan for longer retirements and the cost of care.

Final Thoughts (Not Advice)

The proverb doesn’t say “dig one huge burrow and hope.” It says — be reasonable, practical and prepared. For Gen X and Boomers that means building a base that pays the bills, a growth sleeve that fights inflation, and a flexible option that keeps you moving when markets or life shift.

Start with the 30-day plan. Pick two small things today (check your statement; test a one-month side gig). That’s digging your second and third burrows without dramatic change.

Part 1 Can be Found: Here https://markwhitby.me/a-smart-rabbit-has-three-burrows-a-gen-x-boomer-tip/

Sources & data behind the charts (major citations)

- US inflation (Aug 2025 reporting) and commentary. (Financial Times)

- Federal Reserve — policy rate / target range. (federalreserve.gov)

- RBA cash rate (Aug 2025 cut to 3.60% and Australian CPI context). (rba.gov.au)

- US median retirement savings by age (SCF 2022 summaries / NerdWallet & Fed analysis). (nerdwallet.com)

- Australia average super balances by age (ART / ABS / ASFA compilations). (australianretirementtrust.com.au)

- Side-hustle / multi-job surveys — Bankrate (US), ABS reporting (Australia). (Bankrate)

- Health spending & longevity context — OECD & Health at a Glance reports. (OECD)